reverse tax calculator quebec

Other provinces in Canada do not use the HST and instead use a distinct Goods and Services Tax GST andor Provincial Sales. Montreal land transfer tax example calculation.

3 Things We Wish We Had Done When We Had More Money Debt Management Mortgage Calculator Debt Management Plan

New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island.

. Get a sense of how much you can afford to borrow and what makes sense for you. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Overview of sales tax in Canada.

Sales tax calculator OntarioHST 2016. This calculator can be used as well as reverse HST calculator. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces.

Sales tax calculator GST QST 2016. 51700 first marginal tax bracket 050 tax rate 258 land transfer tax 258600 upper marginal tax bracket - 51700 lower marginal tax bracket 100 marginal tax rate 2069 land transfer tax 517100 mid marginal tax bracket - 258600. Land transfer tax calculator.

Sales tax calculator HST GST 2016. Calculate the amount you will have to pay in land transfer tax depending on your location. Reverse Québec sales tax calculator 2016.

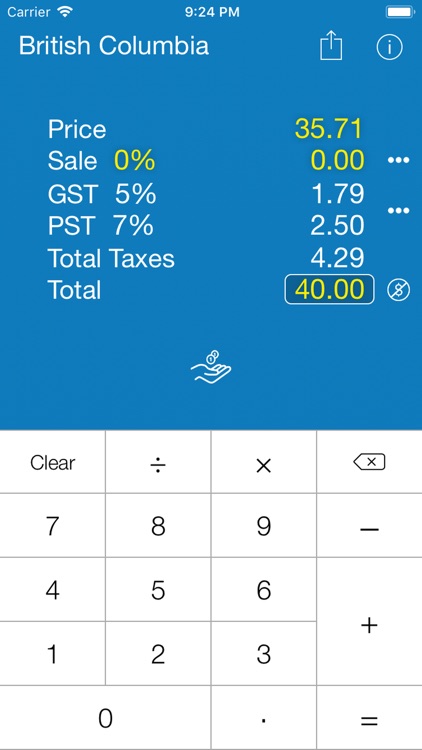

Reverse Sales tax calculator British-Columbia BC GSTPST 2017. By purchasing the Wealthsimple Tax Live package you will get access to our Tax Live service for the current tax year the Tax Live Service. Lets run the same calculation for a home worth 1200000 inside Montreal.

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. See how much your payments could be if you make weekly bi-weekly or monthly payments. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013.

This is very simple universal HST calculator for any Canadian province where Harmonized Sales Tax is used. Reverse sales tax calculator HST GST 2016. Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. You understand that as part of the Tax Live Service a Wealthsimple tax expert Tax Expert will be available to review your federal and provincial tax returns for accuracy and completeness.

Canada Sales Tax Calculator By Tardent Apps Inc

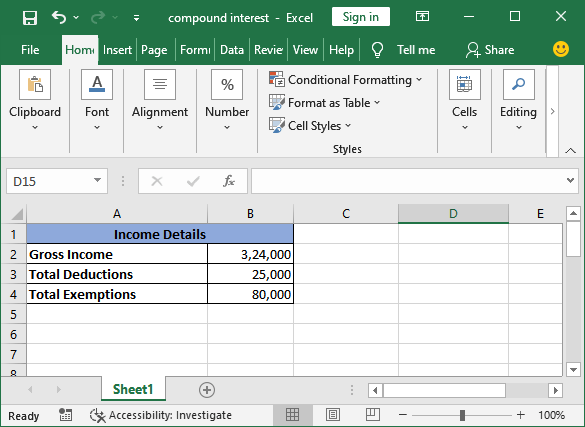

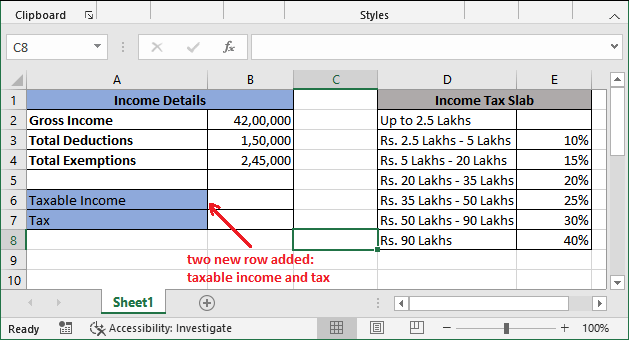

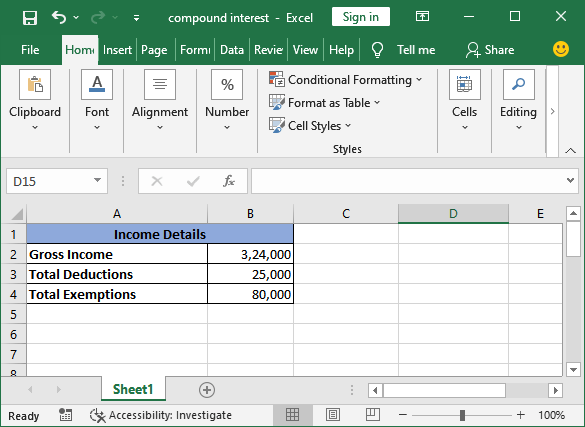

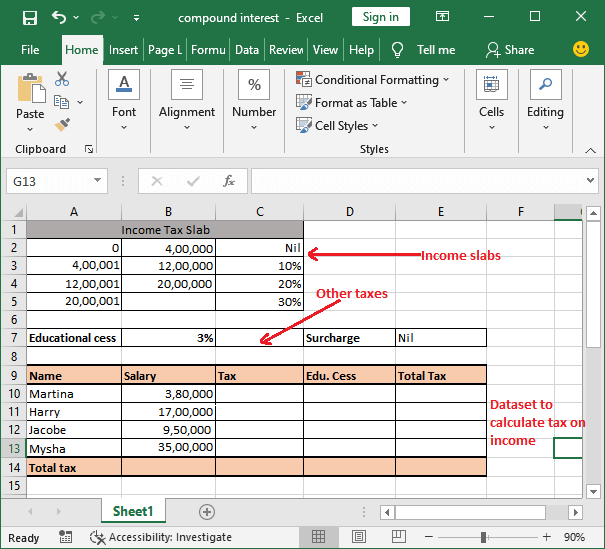

Income Tax Calculating Formula In Excel Javatpoint

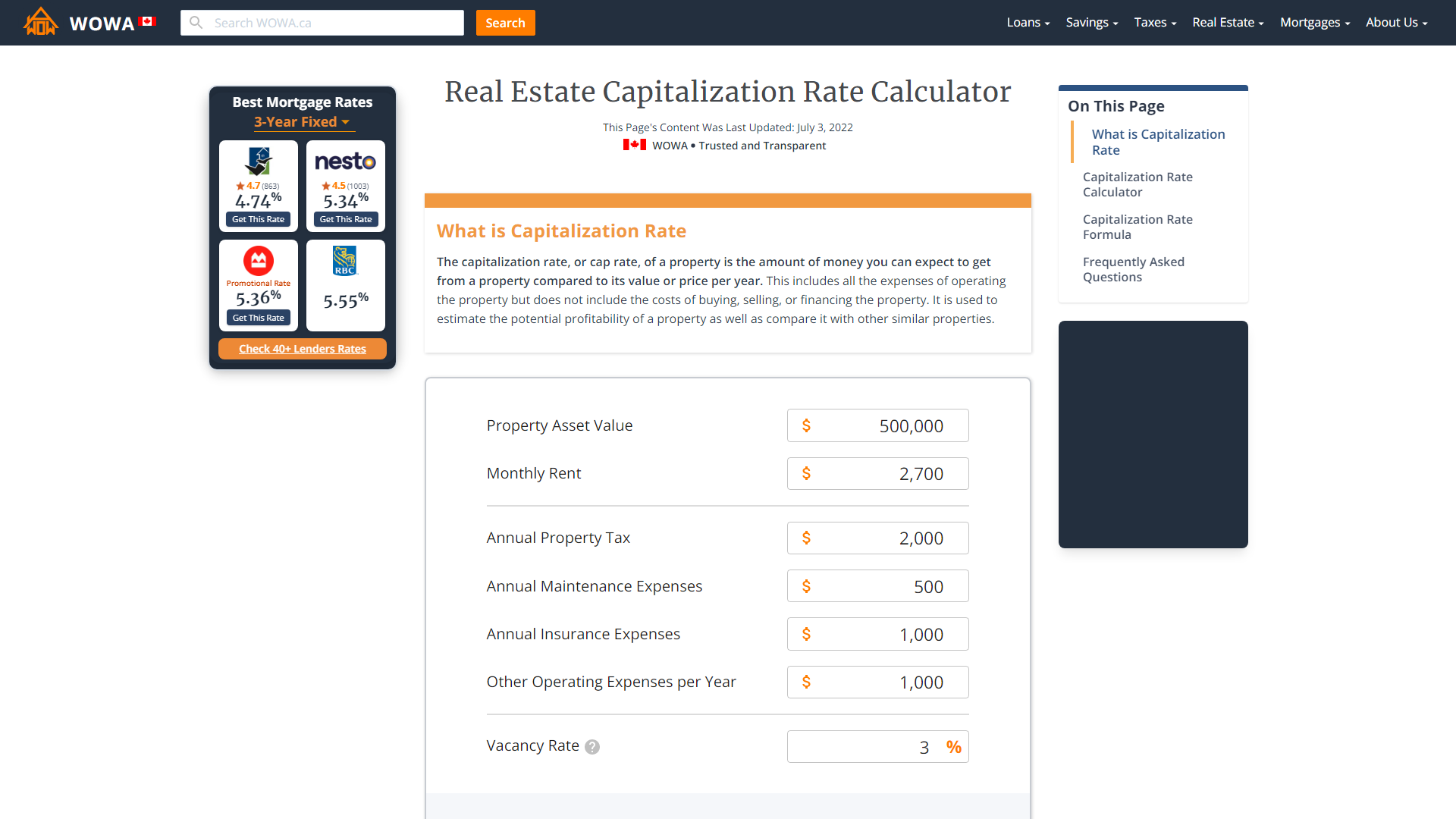

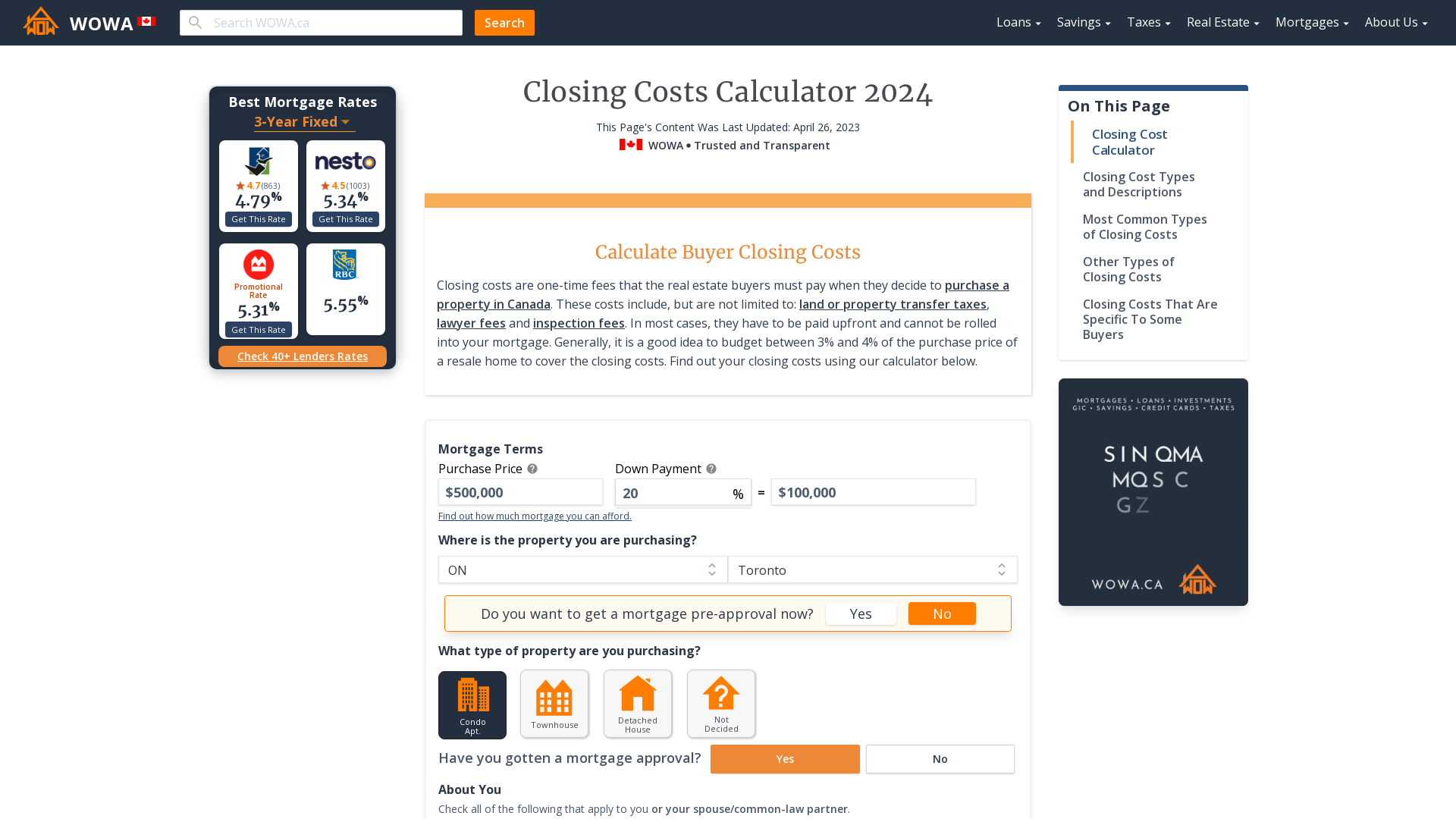

Cap Rate Calculator Formula And Faq 2022 Wowa Ca

Income Tax Calculating Formula In Excel Javatpoint

Pst Calculator Calculatorscanada Ca

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

Home Closing Cost Calculator 2022 Wowa Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Canada Sales Tax Calculator By Tardent Apps Inc

Sales Tax Canada Calculation By Monkeylabs Inc

Uber Driver And Car Requirements Calgary 2019 Guide Uber Driver Uber Car Uber

Canada Sales Tax Calculator On The App Store

![]()

Quebec Sales Tax Calculator On The App Store

Income Tax Calculating Formula In Excel Javatpoint

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

How To Calculate Sales Tax In Excel Tutorial Youtube